The Main Principles Of Custom Private Equity Asset Managers

You have actually probably become aware of the term exclusive equity (PE): purchasing firms that are not openly traded. About $11. 7 trillion in assets were handled by exclusive markets in 2022. PE firms seek opportunities to earn returns that are much better than what can be accomplished in public equity markets. Yet there may be a few things you do not recognize regarding the market.

Partners at PE companies elevate funds and manage the cash to produce positive returns for investors, generally with an investment horizon of in between 4 and 7 years. Private equity companies have a range of financial investment preferences. Some are rigorous sponsors or easy capitalists wholly based on monitoring to grow the business and generate returns.

Since the best gravitate toward the larger offers, the center market is a significantly underserved market. There are much more sellers than there are very seasoned and well-positioned finance experts with substantial customer networks and resources to handle a bargain. The returns of personal equity are generally seen after a few years.

8 Simple Techniques For Custom Private Equity Asset Managers

Flying below the radar of large multinational companies, several of these small business commonly supply higher-quality customer support and/or particular niche products and services that are not being provided by the large empires (https://cpequityamtx.mystrikingly.com/blog/unlocking-opportunities-custom-private-equity-asset-managers-in-texas). Such benefits attract the rate of interest of personal equity companies, as they possess the insights and smart to exploit such possibilities and take the firm to the next level

Many managers at profile companies are provided equity and bonus offer settlement structures that compensate them for striking their financial targets. Exclusive equity chances are often out of reach for individuals that can't invest millions of bucks, however they shouldn't be.

There are guidelines, such as limits on the accumulation quantity of money and on the variety of non-accredited financiers. The private equity organization brings in several of this page the very best and brightest in corporate America, including leading entertainers from Lot of money 500 business and elite monitoring consulting firms. Law practice can likewise be recruiting grounds for exclusive equity hires, as accounting and legal skills are necessary to total deals, and purchases are extremely sought after. https://codepen.io/cpequityamtx/pen/VwgqKQX.

All about Custom Private Equity Asset Managers

One more disadvantage is the lack of liquidity; once in an exclusive equity deal, it is hard to leave or offer. There is a lack of flexibility. Exclusive equity additionally features high charges. With funds under management currently in the trillions, exclusive equity firms have ended up being eye-catching financial investment lorries for well-off individuals and institutions.

For years, the qualities of exclusive equity have actually made the property class an eye-catching proposition for those that can take part. Since access to private equity is opening as much as more individual financiers, the untapped potential is coming true. So the question to consider is: why should you invest? We'll begin with the primary arguments for purchasing private equity: Just how and why private equity returns have actually traditionally been greater than other assets on a number of degrees, How consisting of private equity in a portfolio influences the risk-return account, by aiding to diversify versus market and intermittent risk, After that, we will certainly outline some crucial considerations and threats for private equity investors.

When it concerns presenting a new property right into a portfolio, the many standard consideration is the risk-return account of that property. Historically, personal equity has displayed returns similar to that of Arising Market Equities and more than all various other standard property courses. Its relatively low volatility paired with its high returns creates an engaging risk-return profile.

Indicators on Custom Private Equity Asset Managers You Need To Know

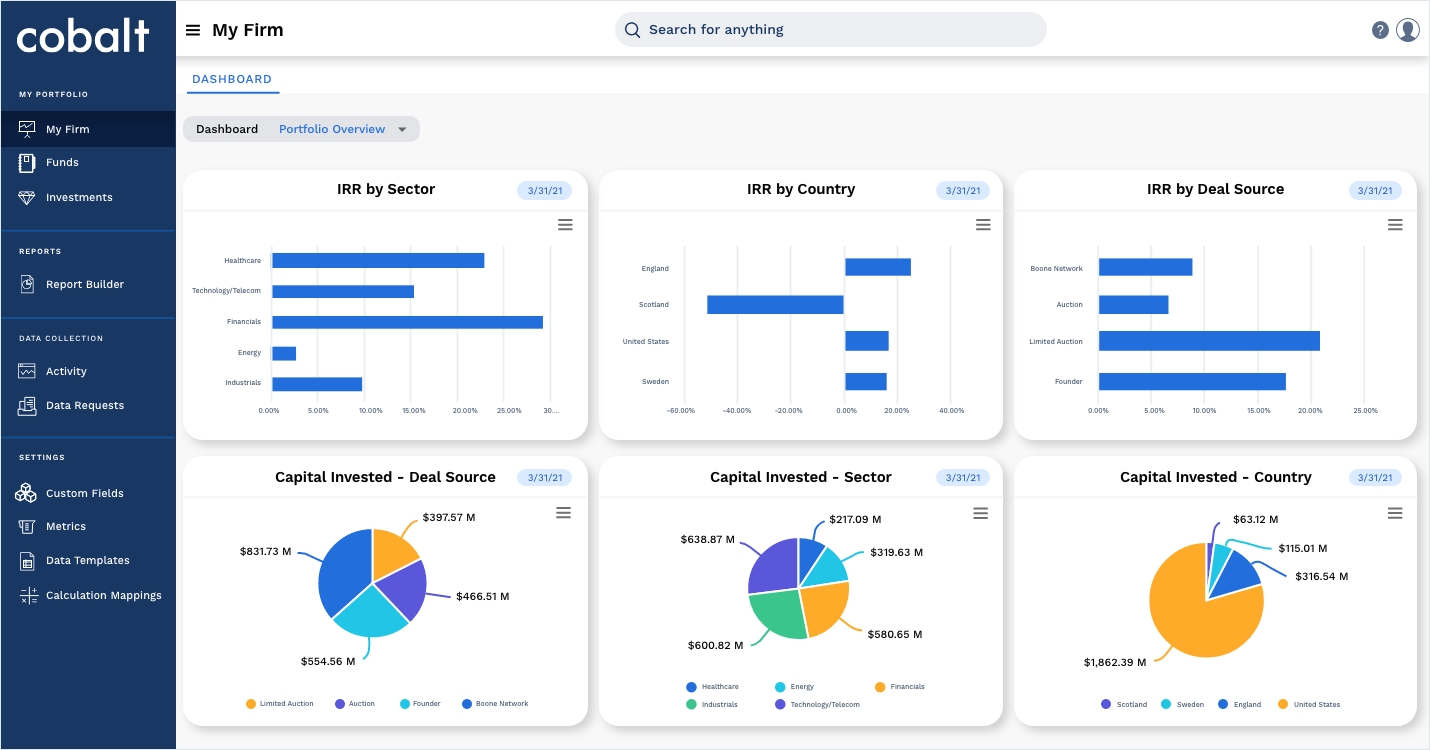

As a matter of fact, exclusive equity fund quartiles have the widest variety of returns throughout all different property classes - as you can see below. Technique: Inner price of return (IRR) spreads calculated for funds within classic years independently and then balanced out. Median IRR was determined bytaking the standard of the typical IRR for funds within each vintage year.

The effect of including personal equity right into a portfolio is - as constantly - reliant on the portfolio itself. A Pantheon research from 2015 recommended that consisting of personal equity in a portfolio of pure public equity can unlock 3.

On the other hand, the very best exclusive equity firms have accessibility to an even larger pool of unidentified possibilities that do not encounter the same scrutiny, in addition to the resources to do due diligence on them and recognize which are worth purchasing (Syndicated Private Equity Opportunities). Investing at the ground flooring suggests higher danger, yet for the business that do be successful, the fund benefits from higher returns

The Definitive Guide to Custom Private Equity Asset Managers

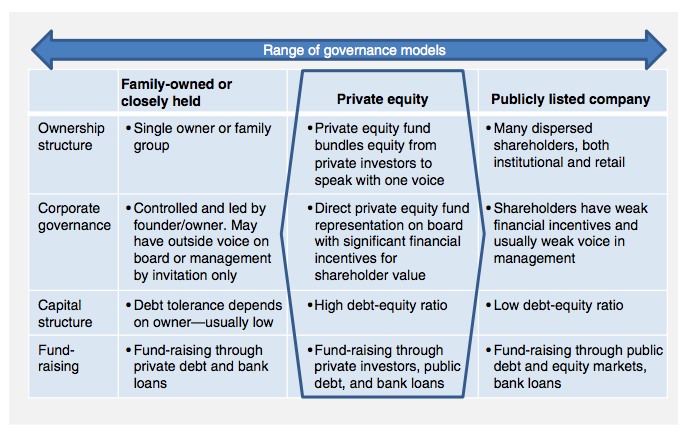

Both public and exclusive equity fund managers dedicate to spending a percentage of the fund yet there continues to be a well-trodden concern with straightening rate of interests for public equity fund management: the 'principal-agent trouble'. When a financier (the 'major') works with a public fund manager to take control of their resources (as an 'representative') they entrust control to the manager while preserving ownership of the assets.

When it comes to private equity, the General Partner does not just earn a management cost. They additionally gain a percentage of the fund's profits in the kind of "lug" (usually 20%). This makes sure that the rate of interests of the manager are lined up with those of the investors. Personal equity funds likewise reduce one more type of principal-agent problem.

A public equity investor ultimately desires one point - for the management to raise the supply cost and/or pay out dividends. The capitalist has little to no control over the decision. We showed over the amount of exclusive equity techniques - particularly majority buyouts - take control of the operating of the firm, making certain that the lasting value of the business comes first, pressing up the return on investment over the life of the fund.